Part 4 in our Series Starting a Short-Term Rental Business

One of the most powerful sets of data you can acquire when conducting your short-term rental analysis is available prior rental history. In fact, we’ve found this information to be perhaps the most sound and reliable predictor of future performance with our properties.

Analyzing the rental history of a property, if it exists, will go a long way to help determine whether it is a sound investment. Rental history offers valuable insights into the performance of a rental property over time and it’s future potential trajectory. Not all properties will have rental history of course, but many do. And sellers and sellers’ agents know that providing prior rental history is a great selling tool to attract buyers and investors.

In this article, we discuss how to use rental history to evaluate a short-term rental investment property.

Look for Rental Income and Occupancy Rates

One of the most important things to consider when conducting your short-term rental analysis is its rental income and occupancy rate. These two metrics provide insight into how much revenue the property is generating and how often it is being booked. While you won’t know in advance what all the expenses are, if you know the historical rental revenue, and combine that with forecasted future revenue, you can get a pretty accurate sense of how well the property will do.

The occupancy rate is equally important because it tells you how much demand there is for the rental property. In many or most cases, sellers will be happy to provide the past history from platforms such as Airbnb and VRBO. These platforms have reports specifically built to provide this type of information.

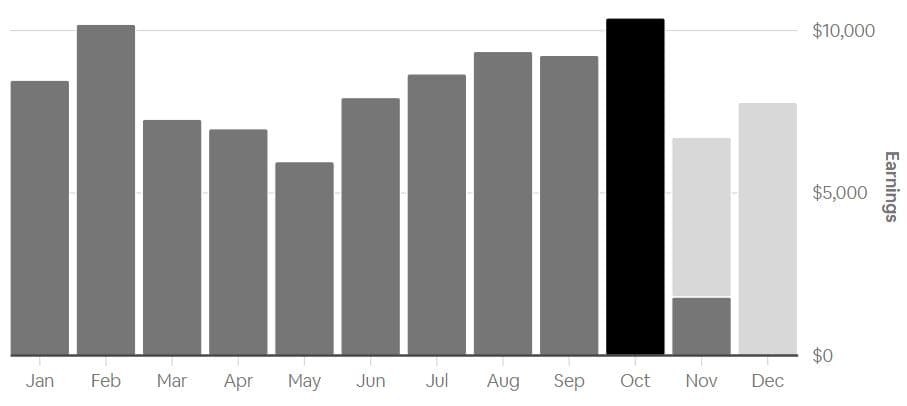

To evaluate the rental income and occupancy rate, look at historical data from the past several years if available. This data should be provided by the current owner or can be obtained from websites that provide historical rental data for specific areas. Keep in mind that seasonal fluctuations can affect these metrics, so be sure to analyze the data for different periods throughout the year.

Analyze Performance Over Time

When evaluating a short-term rental investment property, it is important to look at the overall performance of the property over time. Is there an upward trajectory on rental income, or, is it declining?

Of course an upward trajectory is the ideal, but let’s say you see some downward trends. This isn’t always bad. For example, perhaps the owners were using the property more recently for their personal use. Or, maybe the property was undergoing renovations or repairs and was taken off the short-term rental listings for some time. We have done this ourselves with a few properties.

In some cases a property you are interested in will still be active on Airbnb or VRBO; if so, you can review the property’s calendars and reviews to gain a further sense of how the property is performing.

Evaluate the Marketing Strategy

The marketing strategy used to promote a short-term rental property is crucial to its success. A well-executed marketing plan can help attract more renters and generate higher rental income. When evaluating a property, take a close look at the marketing efforts that are currently being used. How compelling are the listing(s)? Can descriptions and titles be improved? How about better photography?

If you see a property that is doing okay, or even well, but at the same time know you can improve the overall presentation of the property, then this is a good sign for future revenue performance.

Breaking Down Actual Numbers

So what numbers should you be looking at specifically? First, most sellers will provide you with the gross short-term rental revenues. This is fine, as you can surmise what the expenses might be, ie mortgage payment, cleaning, HOA fees if any, etc. But in some rare instances, you might get a very astute seller who has tracked every expense vs revenue. If you can get this, you have a gold mine of data! This will tell you everything you need to know.

Back to gross revenues. Keep in mind that the short-term rental platforms take their fees out of the true gross revenues. So what you might get from a seller is the gross revenues less the platform fees. Again, this is fine as you are going to have to pay those fees if you list on a platform. In short, the gross revenues would be the nightly rental rates, plus cleaning fees charged, plus any extra add-ons that guests might have paid for.

Wrap Up

Every solid short-term rental analysis should include reviewing and evaluating any existing prior rental history. By considering metrics such as rental income, occupancy rates, expenses, occupancy trends, market demand and marketing strategy, you can make an informed decision about whether the investment is worth the risk. Remember to do your due diligence and conduct a thorough evaluation before making a decision. With careful consideration, a short-term rental investment property can generate a steady stream of income for many years to come.

Recent Posts

A Security Camera Overview As an Airbnb or VRBO host, your top priorities are the safety of your guests, the protection of your property, and providing a secure environment that allows your guests...

As we delve into the increasingly popular world of short-term rentals, it's no surprise that many of us are intrigued by the potential to tap into this lucrative trend. One opportunity that stands...